Keeping on top of your business finances is a must for small businesses. It is the key to a strong foundation for growth and success. You need to:

- understand the money coming in and out of your business

- pay bills on time

- get paid on time for your services/products

- meet your tax and reporting obligations

- make decisions about your future direction and investments.

These are all underpinned by sound financial management practices.

Many small business owners choose to outsource their financial activities. This frees them up to focus on other aspects of their business. The things that best suit their skills and that they enjoy doing more.

However, a common point of confusion is understanding whether you need to outsource to a bookkeeper or an accountant. The reality is that you need both, but they play different roles in your business financial management.

So here we have look at the difference between bookkeeping and accounting. And the importance of them working together to support your business finances.

What is the difference between a bookkeeper and an accountant?

A very valid question! This is something we get asked about a lot. So, let’s break it down in a simple way.

A bookkeeper handles the recording and organising of financial information.

This could include:

- tracking money in/out (accounts receivable and accounts payable)

- preparing and paying invoices

- processing payroll

- maintaining your general ledger

- lodging Business Activity Statements (if they are a qualified BAS agent)

An accountant uses the financial data recorded by bookkeepers. They interpret and present that data back to business owners, investors or other parties.

Accounting activities could include:

- preparing budgets

- compiling financial reports

- submitting tax returns

- analysing business performance

- providing insights into trends and business growth

- communicating with the ATO on your behalf

Accounting is a level up from bookkeeping. It involves analysing and making subjective decisions about what financial data means. Whereas bookkeeping sticks to tracking financial numbers and data.

In small businesses, there can be some overlap in the activities performed by an accountant or bookkeeper. An accountant can perform the activities a bookkeeper does. But a bookkeeper doesn't have the proper qualifications to undertake all the activities of an accountant.

When do I need an accountant vs a bookkeeper?

Many businesses use a bookkeeper on an ongoing basis (daily or weekly) to help them manage their regular business transactions. They may only use an accountant a few times a year, such as when they need to lodge a tax return or deliver a financial report.

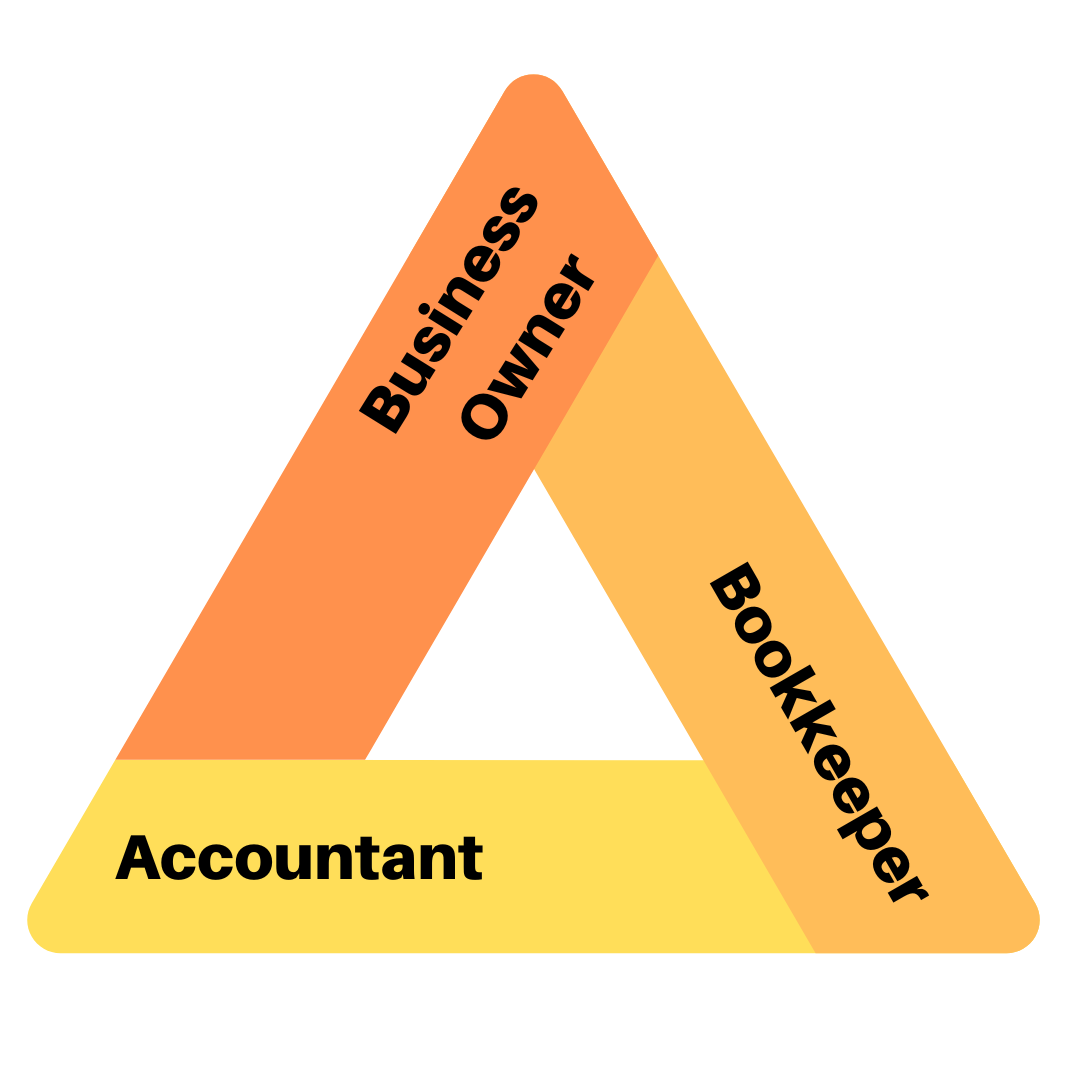

Business Owner + Bookkeeper + Accountant = The Golden Triangle

The best approach is to build a collaborative team including the business owners/s, bookkeeper and accountant.

A bookkeeper knows your day-to-day financial situation inside out, and can help identify areas of opportunity or risk. They are essential to keeping your business operations financially sound.

An accountant relies on a business being able to provide them with accurate financial data. They depend on having access to complete and reliable financial data to provide insights and advice.

A business owner relies on both to manage their financial obligations and help them grow. The business owner also needs to provide direction on their business goals, opportunities and constraints.

If your bookkeeper and accountant don’t have a harmonious working relationship, this can cause risks for your business. Issues can include:

- Disputes over ‘territory’ and who ‘owns’ what

- Bookkeepers performing tasks they aren’t qualified to do, which the accountant then needs to clean up or redo

- Missed opportunities for tax reductions

- Incorrect information supplied to the ATO

- Fines from the ATO for late submissions

- Being charged extra fees for rework

- Confusion, errors, duplication and wasted effort resulting from a lack of communication between all parties.

The benefits of an in-house accountant

Here at Dream Admin Services we offer bookkeeping services. We aren’t accountants, but we partner with in-house accountant. Katie Price, from Price Perspective, has over 20 years’ experience as a chartered accountant and tax agent. If our clients don’t have a regular accountant or are looking to switch, we generally recommend Katie.

We have seen the benefits of working with an in-house account for many of our clients. Some of these benefits include:

- Reduced workload on the business owner. Less need to act as go between bookkeeper and accountant. We communicate with each other directly and keep the business owner informed too

- Smoother and easier tax time experience. When your bookkeeper and accountant are working together over the course of the financial year there are no surprises come tax time

- Increased accuracy of financial data by using the same systems and accounting practices

- Cost savings through reduced admin and streamlined processes

- Access to expert business advice bringing together the insights of bookkeeper and accountant

If you already have an accountant that is ok too. We build a collaborative working relationship with all our client’s accountants. This way we can best serve the interests of you and your business.

If you want to know more about outsourcing your bookkeeping to Dream Admin, book in for a free, no obligation chat with Managing Director Tennille Skelly.